While 2020 has gotten off to an extraordinary start, there are a few things that have remained constant - income taxes being one of them. In light of the current situation, however, the Singapore Government has offered automatic deferment of income tax payments for self-employed individuals, who may have been negatively affected by COVID-19.

For the rest of us, we should be receiving our Notices of Assessment soon, which also means it's time to start considering the different payment methods, searching for the one most convenient and rewarding way to make these payments to the tax authorities.

Making income tax payments with your credit card

CardUp enables you to use your credit card for a range of different payments that don't already accept card payments – income tax included. This lets you earn credit card rewards such as miles, points and cashback on this large, one-off payment, giving you additional savings!

Maximising the rewards earned on your cards

By paying your income tax with your existing credit cards through CardUp, you earn rewards on every dollar you spend. This means you earn air miles, cashback and points for a payment that typically does not earn you rewards when you pay via other methods.

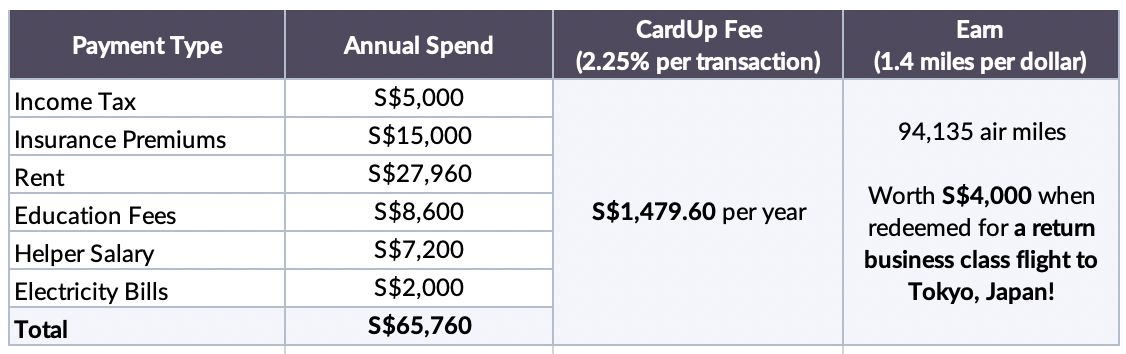

Together with other payments that can be made on CardUp – such as your rent, insurance, education fees and more – you can easily earn thousands more miles or points each month. This lets you redeem your business class tickets many times faster compared to just putting on your regular day-to-day spend (dining, entertainment, transport etc). Here's an example as to how you'll be able to earn 94,000 air miles in a year for these large, recurring payments that you'll have to make anyway:

This means that at just $1,480 in fees paid, you'll be able to redeem a business class trip to Tokyo worth around $4,000. This is savings of almost 63%! - and to be just in time for when the situation hopefully gets better for your next holiday!

Not sure which cards you should be using for your income tax payments? Check out our recommended list of cashback cards for your CardUp payments!

Save even more with lowered fees for your 2020 income tax

Enjoy discounted fees and hence more savings for your income tax payment this year!

Redeem an exclusive $25 off your first CardUp payment with ‘MEREWARDS25’ or if are using an American Express Card, check out the below income tax promotion.

AMEXTAX24 - 2.4% fee for American Express® Card Members

Get lowered fees of 2.4% (u.p. 2.6%) when you use your favourite American Express Card for your income tax payments with promo code AMEXTAX24. Payments must be scheduled on the platform before 23 July 2020.

American Express is also running a double-earn promotion currently for Platinum Charge and Centurion Card Members, letting you earn 4 Membership Rewards® points and 5 Membership Rewards® points, respectively, for every full S$1.60 spent (an equivalent of 1.56 miles and 1.95 miles per dollar spent respectively) on your income tax payment!

Full terms and conditions apply.

Convenience of online payment setup

CardUp also gives you the convenience of making your payment directly to the tax authorities online, unlike other credit card options that require manual form submission with the payment going back to your bank account, which means you still need to do an additional step of actually getting the payment into your tax account.

While setting up your tax payment, CardUp automatically inputs your tax number from your linked NRIC in your registered account, thus eliminating any chances of errors. To ensure that you pay the right amount, your payment is also only processed when you enter the exact outstanding amount in your Notice of Assessment.

Secure payments and trusted by customers

Payment security is definitely one of CardUp’s biggest priorities. All payments are processed with bank-level security and your information is protected with 128-bit encryption and physical security in the same way that banks do. In addition, our payment gateway is PCI-DSS Compliant - CardUp does not store full card numbers and other sensitive details. Furthermore, all funds processed through CardUp are held in a safeguarded client money account and these funds, when being delivered to your recipients, are never retained for more than 3 hours.

CardUp has managed hundreds of millions worth of personal and business transactions for customers in the past few years and is trusted by customers for their big payments.

Here's how to get started:

1. Sign up for a free CardUp account

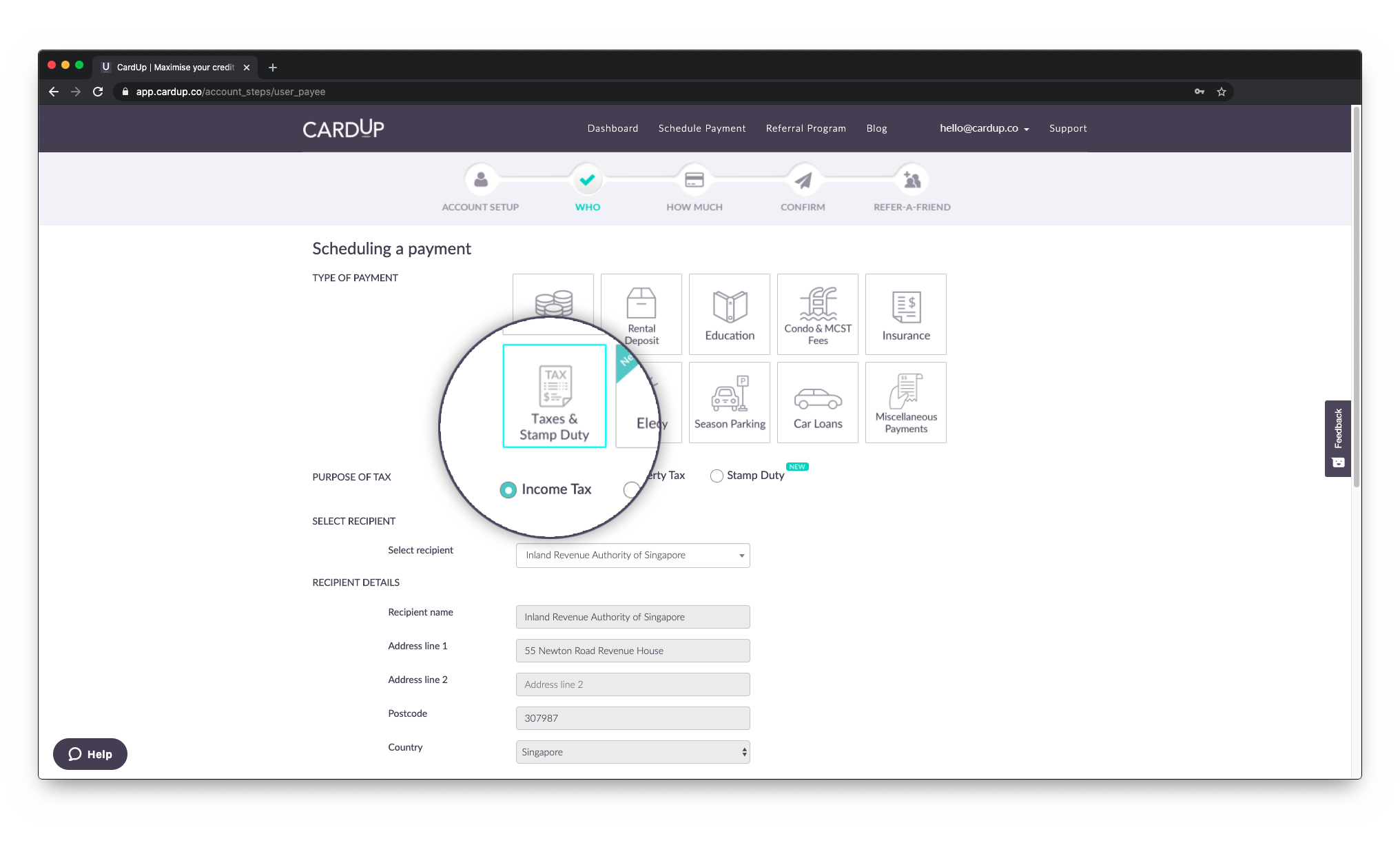

2. Schedule a payment, and select Income Tax under the Taxes & Stamp Duty payment category

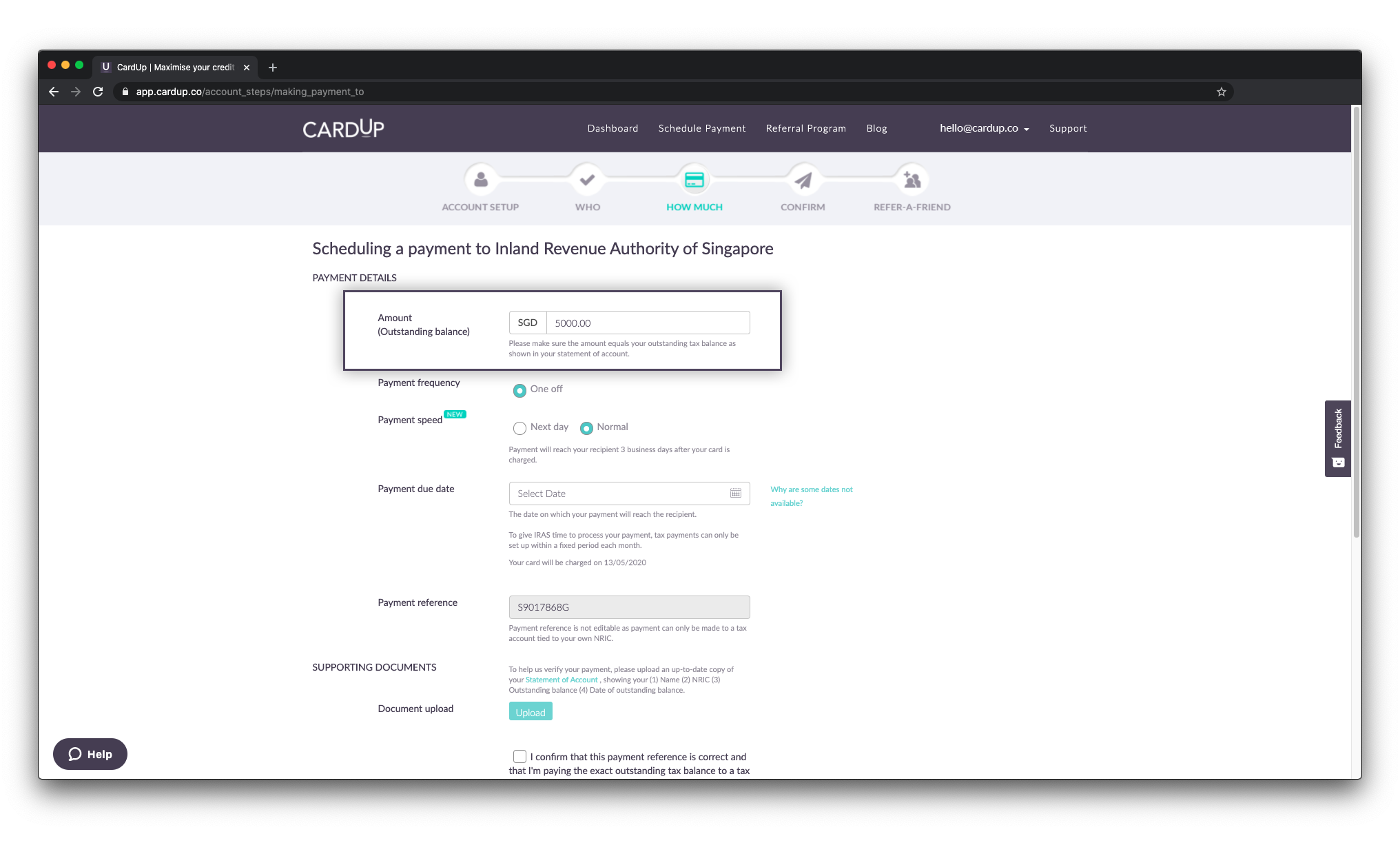

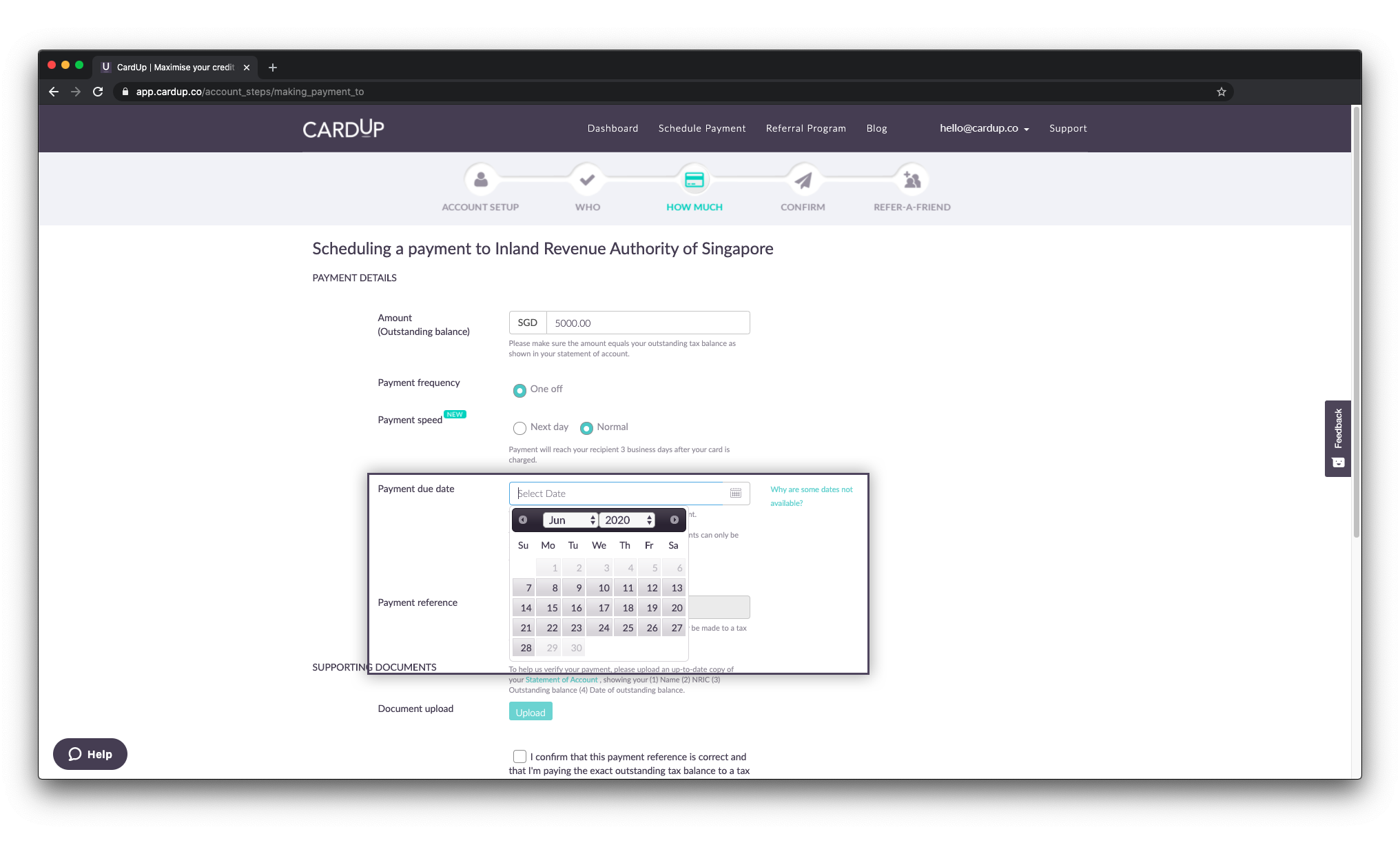

3. Fill in the payment amount as per the outstanding tax balance as shown in your Statement of Account. Do note that you can only set up a one-off tax payment to the tax authorities via CardUp each fiscal year.

4. Select the payment due date. For income tax payments only, payment due date cannot be selected five business days before the 6th of every month to allow the tax authorities sufficient time to process your payment.

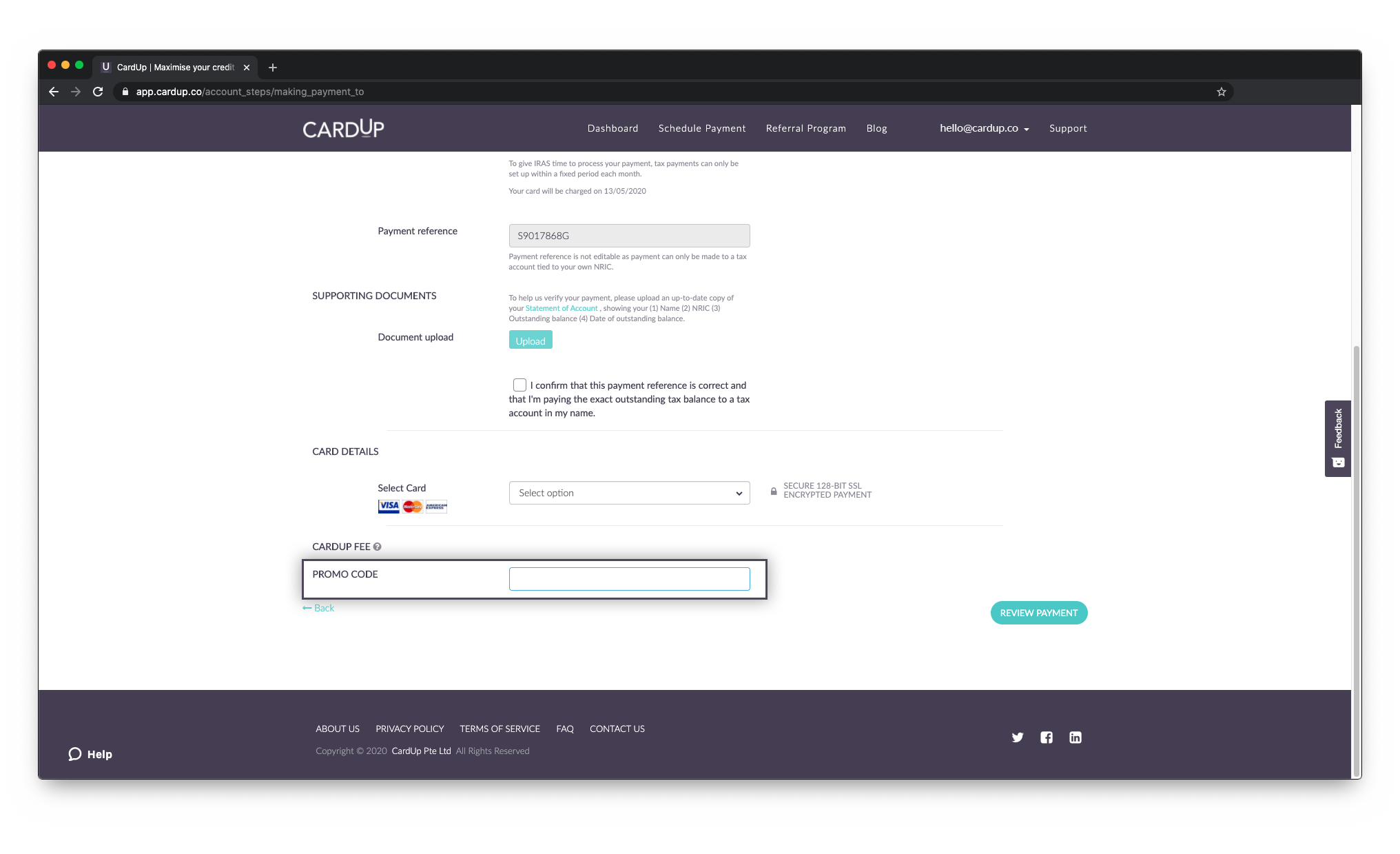

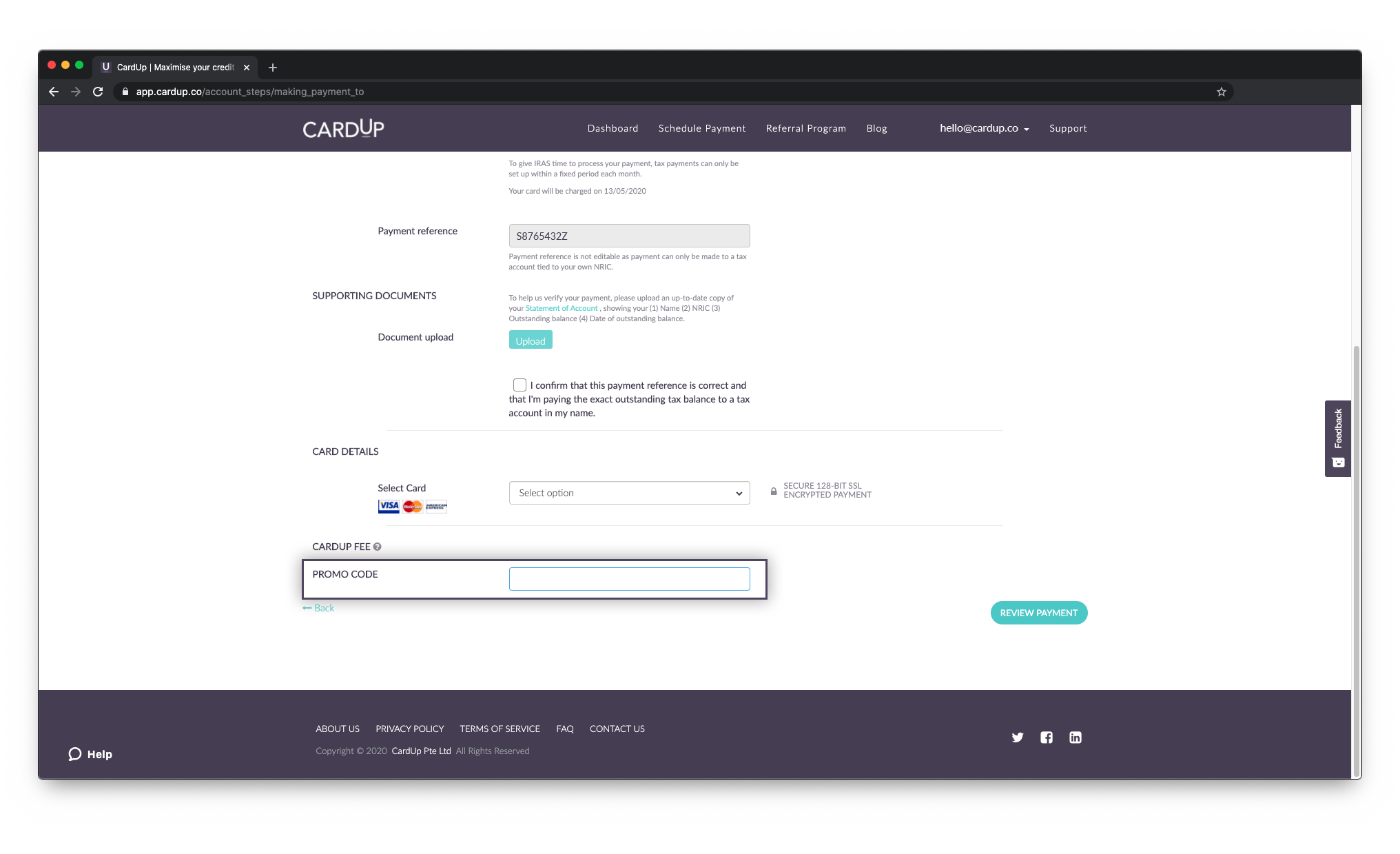

5. Your payment reference number is automatically pulled from the NRIC number registered on your CardUp account. This prevents any erroneous payments to the wrong tax accounts not tied to your own NRIC. You are also required to upload an up-to-date copy of your Statement of Account, showing your Name, NRIC, Outstanding balance and Date of the outstanding balance for us to verify your payment.

6. Select your credit card, enter your promo code (if any), and you're good to go!

7. The tax authorities will then receive your tax payment on the specified due date, with no need for you to notify them of this payment. 3-5 business days after the due date, you can log in to myTax Portal to check that the payment has been posted to your account.

Use CardUp this tax season and experience the benefits first hand.

This article was first produced by CardUp. To enjoy this promotion, visit our Coupons page here to enjoy $25 off your CardUp fee when you make your first payment.